EveryDollar review: Baby steps to budgeting

Image: Michael Ansaldo/IDG

Image: Michael Ansaldo/IDG

At a Glance

Expert’s Rating

Pros

Easy-to-use budgeting featuresGuides user through Dave Ramsey’s “baby steps” to budgeting

Cons

No reporting featuresNeed paid subscription to sync bank accounts

Our Verdict

Ramsey’s baby-steps budgeting method in EveryDollar offers a clear path for those just starting to manage their household finances, particularly those who are digging out of debt and who aren’t yet ready for investments and wealth management.

Price When Reviewed

Free Version Available | Premium $129.99 per year

Best Prices Today: EveryDollar

RetailerPriceEverydollarFreeView DealPrice comparison from over 24,000 stores worldwideProductPricePrice comparison from Backmarket

When you get on the budgeting bandwagon, you face a host of perplexing decisions. Do I pay off my credit cards first or start building an emergency fund? What’s more important: saving for my kids’ college education or my retirement? The ensuing confusion causes many to abandon budgeting altogether.

Everydollar

EverydollarThe Every Dollar app is part of personal finance guru Dave Ramsey’s “Baby Steps” method for providing budgeting newbies a road map. Think of it as the facilitator for the journey. Like YNAB, it’s based on the envelope method and the principle of giving a job to every single buck.

Note: This review is part of our roundup of the best budgeting software. Go there for details about competing products and how we tested them.

Once you create an account on the website, you’re ready to build your first budget. Every Dollar starts you off with eight main budgeting categories: Giving, Savings, Housing, Transportation, Food, Lifestyle, Insurance & Tax, and Debt. You can add more to tailor your budget to your needs. You can also create savings categories—called “Funds” in Every Dollar parlance—which carry a month-to-month balance as you save toward your goal.

At the start of each month, you can enter your income for the month or just the current pay period. Then you assign amounts from those available funds to the “planned” field for each category. As you enter transactions in any category, the amount spent is deducted.

Michael Ansaldo/IDG

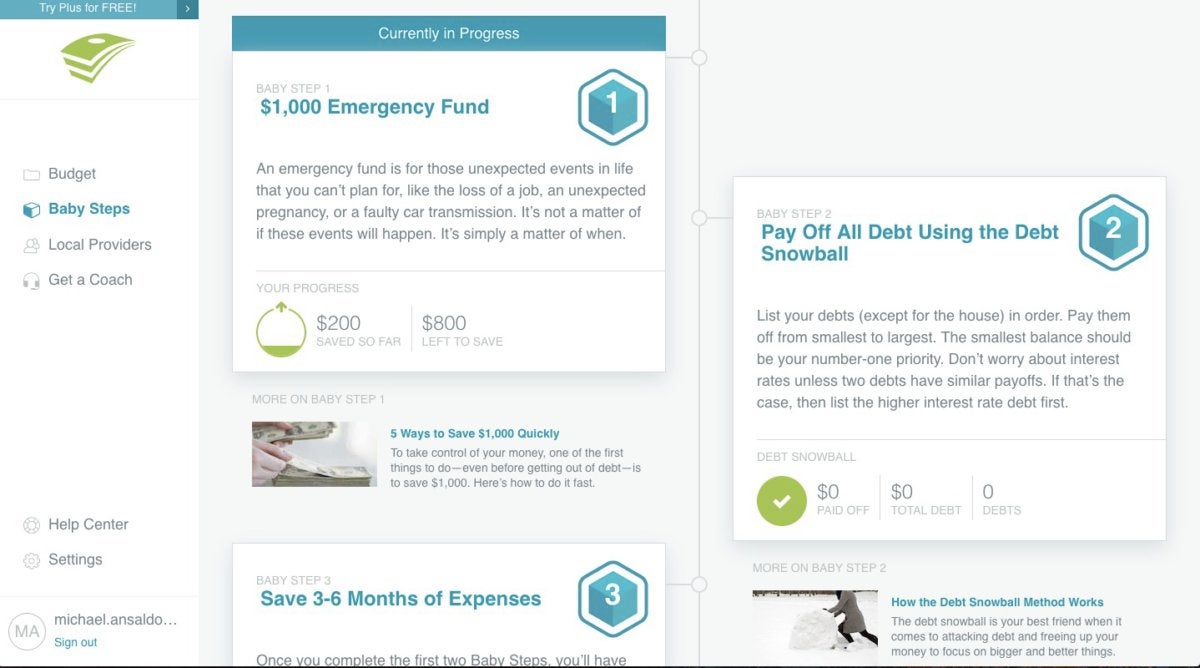

Michael Ansaldo/IDGEvery Dollar guides users through Dave Ramsey’s seven “baby steps” to budgeting.

As you execute your budget each month, Every Dollar guides you through Ramsey’s seven baby steps to financial solvency:

1. Save a $1,000 emergency fund

2. Pay off all debts using the snowball method

3. Save three to six months of expenses

4. Save 15 percent for retirement

5. Start a college fund for the kids

6. Pay off the house

7. Build wealth and give

Each step is to be completed before moving on to the next one. Clicking Baby Steps from the left menu bar will show your progress. In addition to displaying the dollars you’ve accrued or paid off for each goal, this page offers tips pulled from Ramsey’s blog for tackling each step.

Unfortunately, Every Dollar doesn’t include any reporting features. There is a colored graph on right sidebar that displays category breakdowns of your spending, but it’s there for an at-a-glance status update rather than to provide any deep insights.

Every Dollar is free to use, but you’ll have to add transactions manually. A paid version allows you to connect with your bank accounts and automatically sync transactions for $99/year. You can try it free for 15 days.

Sticking to the plan

Ramsey’s baby-steps budgeting method offers a clear path for those just starting to manage their household finances, particularly those who are digging out of debt and who aren’t yet ready for investments and wealth management. Every Dollar makes sticking to that plan a whole lot easier. Sure, you could implement Ramsey’s strategies with a lot of other budgeting software, but when you have an app that’s tailored to it, why would you want to?

Best Prices Today: EveryDollar

RetailerPriceEverydollarFreeView DealPrice comparison from over 24,000 stores worldwideProductPricePrice comparison from Backmarket