Whistleblower Software rebrands, expands into compliance with $16M

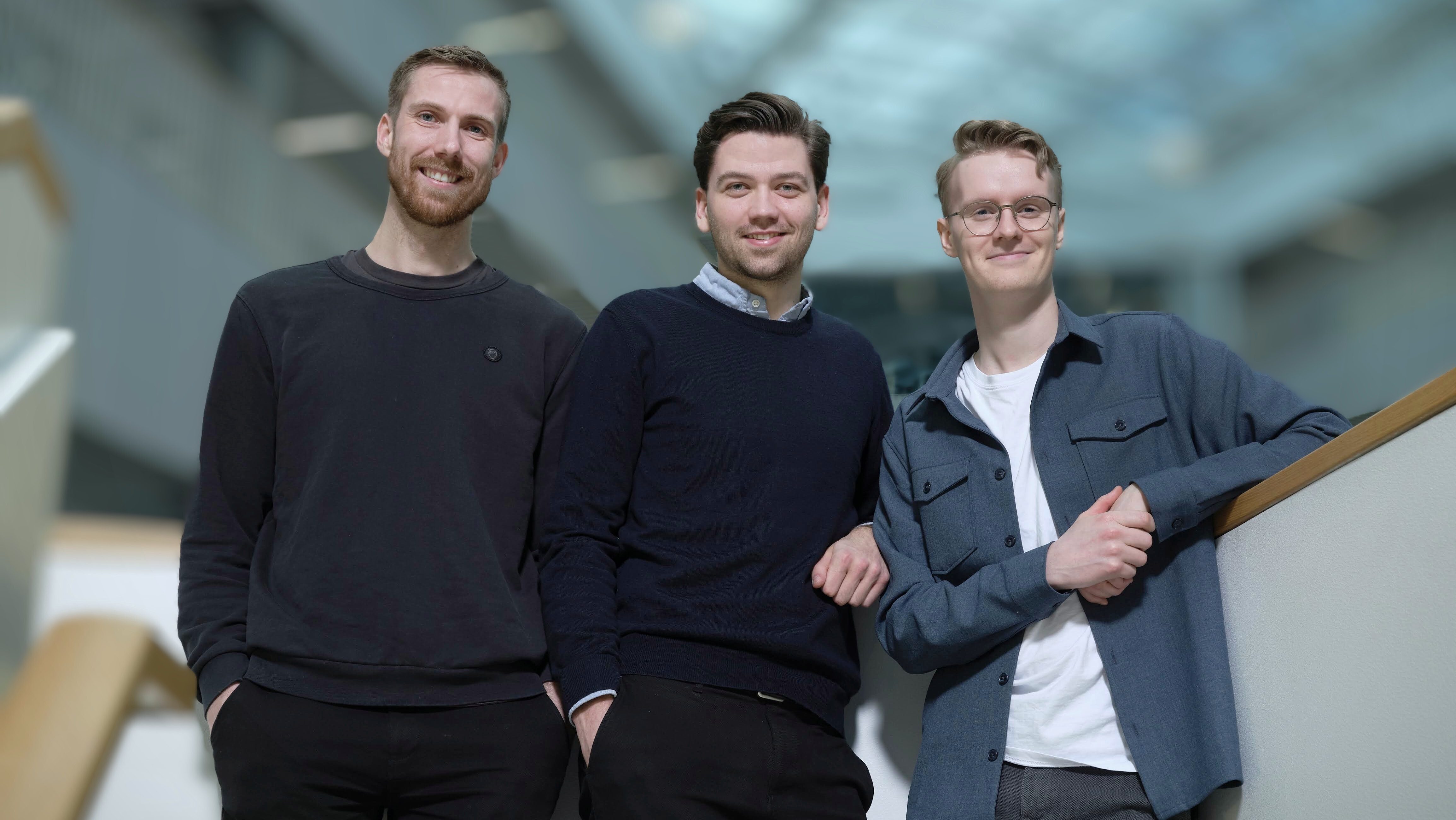

Danish startup Whistleblower Software is rebranding as Formalize as it expands into the broader compliance software sphere — and it has raised a fresh €15 million ($16 million) to fund the expansion.

The announcement comes as the compliance software market has exploded, due in large part to growing regulatory pressure — and investors have taken note. Private equity giant Thoma Bravo took German compliance and investor relations software company EQS Group private in a $435 million deal last month, while startups Cypago, Hyperproof, Certa, and Anecdotes have all raised sizable venture rounds for various flavors of compliance software these past few months.

And now Formalize wants a larger piece of the $54 billion GRC (governance, risk, and compliance) pie too.

“The compliance software market is booming, driven by the EU’s robust regulatory agenda,” Formalize co-founder and CEO Jakob Lilholm told TechCrunch over email. “While compliance is beneficial for society, it can burden companies without efficient management tools.”

Whistleblow while you work

From the Facebook and Cambridge Analytica data harvesting scandal through Tesla’s accident report revelations last year, whistleblowing has played a major contributing part to some of the biggest news stories in recent times — but conscientious workers are often deterred from reporting internal misdeeds due to fears of retaliation.

Formalize emerged in 2021 after Europe’s new whistleblowing directive came into force, requiring most larger companies to introduce internal reporting systems for whistleblowers to safely report corporate wrongdoings in confidence. Businesses with more than 250 employees had to implement their systems by the end of 2021, and those with between 50 and 249 employees were given until December 2023 — two months ago.

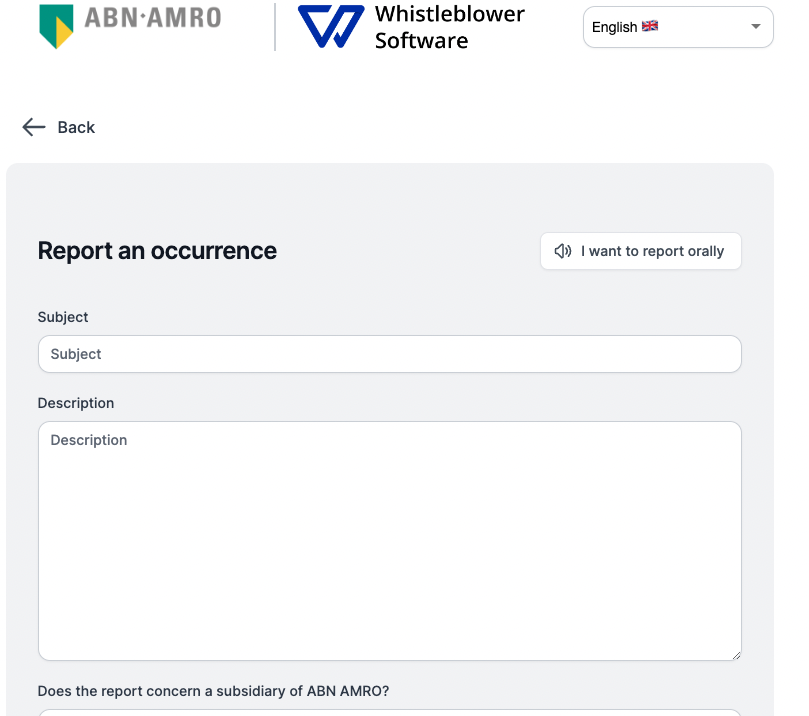

And this, essentially, is what Formalize helps companies achieve. Its customers integrate the whistleblowing software to offer employees a way to file a report anonymously in writing, while those who want to report orally can do so safe in the knowledge that the software distorts the caller’s voice.

Formalize claims a slew of big-name customers already, including McDonald’s, Gap, and Dutch banking giant ABN AMRO.

Compliant

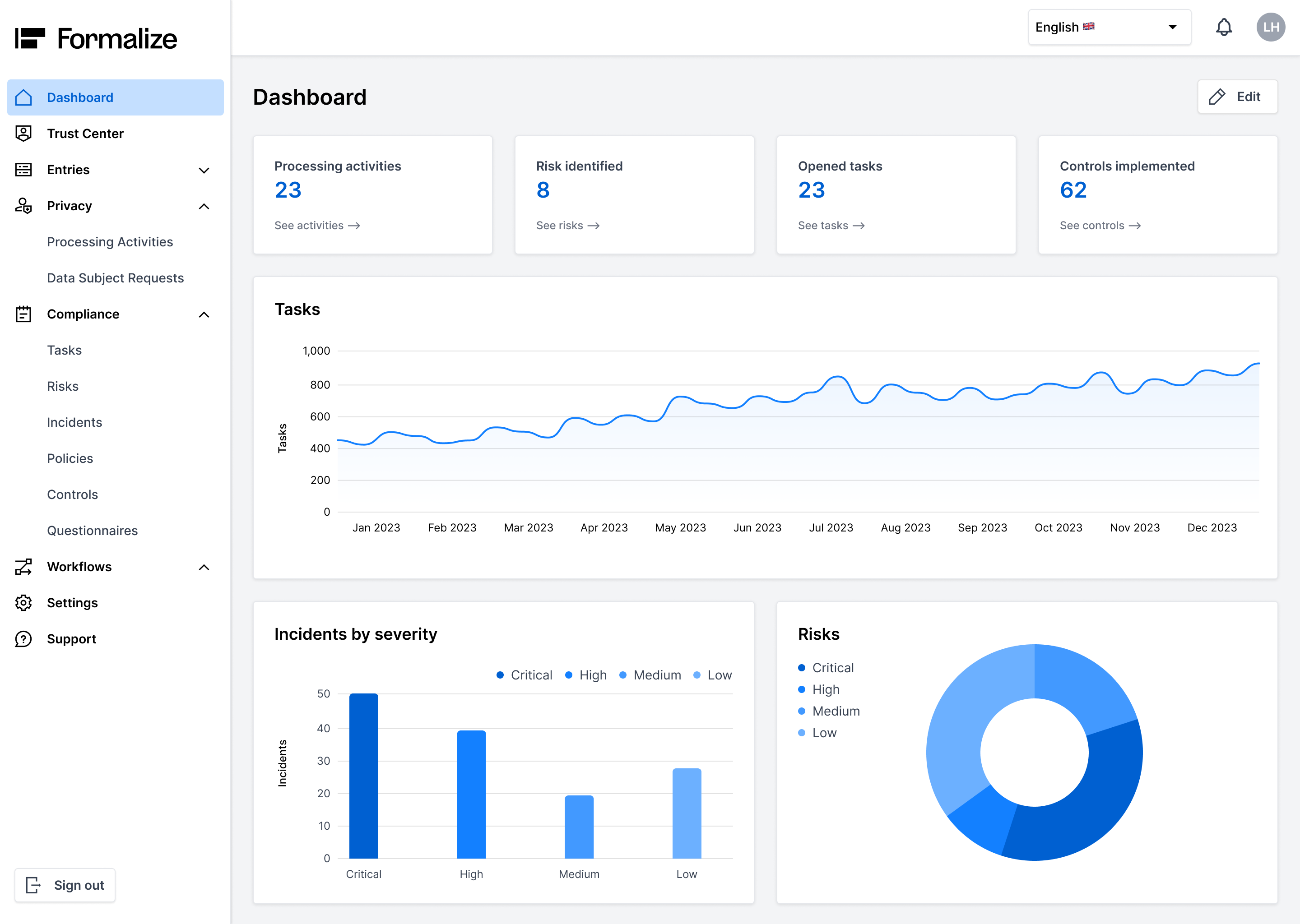

Formalize raised a $3 million seed round of funding 16 months ago. And with another €15 million in the bank, the company is now gearing up to expand beyond whistleblowing software with the launch of a new compliance platform designed to “gather, structure, and automate” all the compliance work that companies are increasingly expected to engage in as part of GDPR data protection laws in Europe. It’s also worth noting the NIS2 cybersecurity regulations, which have provisions for data security, entering into force last January with European member states given until October this year to transpose it into national law.

“Each new law, like GDPR or the upcoming NIS2, requires time to implement and operate — effectively managing regulations is a business advantage in an evolving landscape of new legislation,” Lilholm said.

The new compliance system can be integrated with other systems such as CRMs or supplier databases — this enables companies to conduct all their risk assessments and incident reports from a single interface, as well as map data processing activities, policies, and tangential GDPR procedures.

This is also why the company is changing its overarching company name from Whistleblower Software, as it diverges from its initial focus into a far more extensive (and lucrative) market.

“[Data compliance and whistleblowing] are primarily connected by the intention of the [GDPR] regulation,” Formalize co-founder and CTO Kristoffer Abell told TechCrunch. “Where whistleblowing is enforced to help companies detect noncompliance across a wide range of areas of ethics and compliance, most other compliance areas are there to define a new standard for organizational responsibility that aligns better with the public interests.”

For its €15 million Series A round, Formalize has ushered in France’s BlackFin Capital Partners as lead investor, with participation from the startup’s seed round lead investor, London-based West Hill Capital.