Solo GP fund Andrena Ventures hopes to carry startup talent onto its next challenges

In the world of startups, it’s not uncommon to see talent from successful companies go on to found their own ventures. This is particularly evident in fintech in Europe, where alumni from unicorns like Monzo, N26, Revolut and others have started a flurry of new companies.

Andrena Ventures, a solo GP (solo general partner) fund based in the U.K., wants to support this startup factory snowball effect by investing in such second-generation startups at the pre-seed and seed stages. To do so, it is raising $12 million from backers, including several VCs and entrepreneurs. There has been a first close, with a final close planned for later in the year.

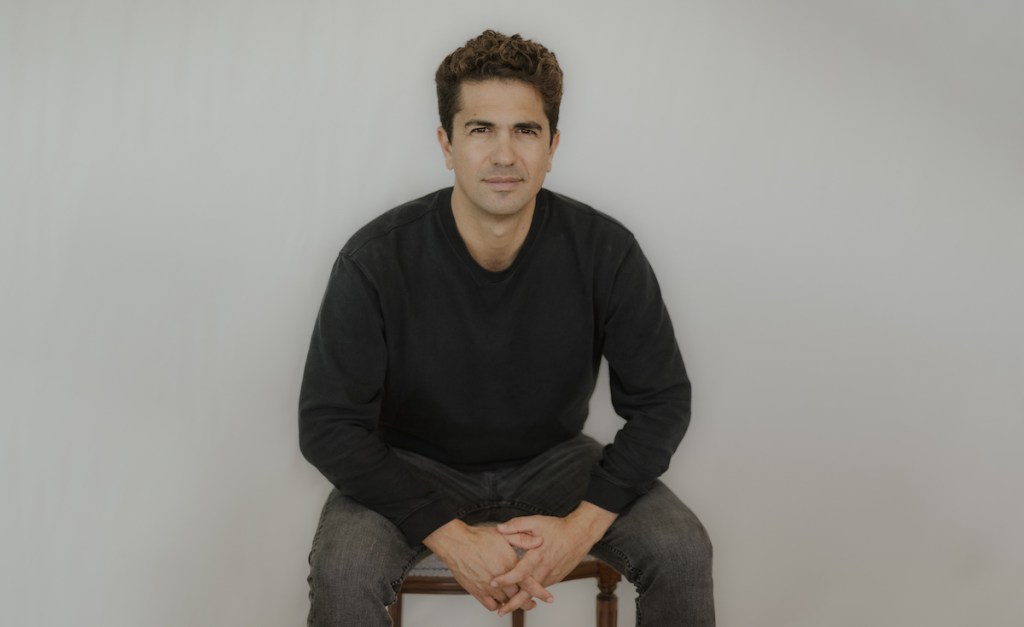

The firm’s general partner, Gideon Valkin, told TechCrunch that while he will fund talent with roots in European and British fintech, Andrena itself is sector agnostic. He expects most of his portfolio companies to focus on other categories like AI, climate tech and B2B enterprise solutions.

Andrena has already made its first investment: Nustom, an AI startup founded by Monzo’s co-founder, Jonas Templestein, whom Valkin reported to when he worked at Monzo. Nustom hasn’t publicly launched yet (which explains its succinct website), but it already boasts a long list of investors, including OpenAI, Balaji Srinivasan, Garry Tan, Naval Ravikant and others.

Andrena’s participation in Nustom’s party round reflects the firm’s thesis and strategy: Most of the time, it will contribute between $100,000 and $400,000 to rounds that will be led by others. However, Valkin hopes that his network will make it easier for founders to raise Series A rounds, potentially from his limited partners or from other investors he’s connected to.

The solo GP approach

By leveraging his network and by writing relatively small checks, Valkin hopes to gain access to hot deals in which larger funds may not be able or willing to participate.

Having a small fund means that small investments have the potential to return all of the invested capital; for a larger firm, such investments wouldn’t move the needle or be worth the risk. Valkin knows that side of the equation: After leaving Monzo, he became an angel investor himself and started working as a seed investor at VC firm Entrée Capital, which is now one of Andrena’s limited partners.

But managing a solo fund isn’t without challenges, and not just because the management fees are proportionally smaller. As my colleague Rebecca Szkutak noted last year, “emerging managers have been on the same roller coaster as startups for the last few years.”

Valkin says he’s taken a significant pay cut, but he sees this as a plus: Founders can see him as a trusted partner who has equally as much at stake. “I think that aligns us really nicely,” he said. His value proposition is to open up his network to founders and help them raise a Series A round, while also relying on his operational know-how.

This mix is more common in the U.S. than in Europe, where many local VCs have never started a company. But things are changing, and angel investing is increasingly common among European entrepreneurs, especially in fintech.

One of Andrena’s LPs, Taavet+Sten, is an investment vehicle run by Wise co-founder Taavet Hinrikus and Teleport co-founder Sten Tamkivi. Both are former Skype employees and have now formally launched an early-stage venture fund, Plural, with two other partners.

The fact that the pair chose to back Valkin can be seen as a validating signal for his thesis. With swarms of early fintech employees looking for their next challenge, the name that Valkin picked for his venture is fitting: Andrena is a type of bee, and “pollination, in my mind, is probably the best analogy for what I do,” he said.

This story has been corrected to reflect the fact that the fund hasn’t reached its final close yet.